Table of contents

Do you want to increase sales and build even better relationships with your customers?

Each customer is, at the same time, different and unique. Why, then, treat them “like everyone else”, sending generic and mass messages? Let’s approach them in a more personalized way! Let’s analyze their consumption behaviors, know their needs and create the ideal message.

In other words, LET’S SMARTLY SEGMENT!

But first, a pause for reflection:

- Which customers should receive the most attention among all customers?

- How to monitor when this customer gains or loses importance and what is the criteria for determining such importance?

- Which customer is more important: the one who buys frequently, the one who spends a lot, or the one who just bought?

- Which customers are stopping buying from you?

Now, let’s go after these answers …

RFM Analysis

RFM analysis — recency, frequency and monetary [value] — is a marketing technique used to quantitatively determine which customers are the best, examining how recently a customer purchased (Recency), how often he buys (Frequency) and how much the customer spends (Monetary value). It is based on the marketing axiom that “80% of your sales come from 20% of your customers” — also known as the Pareto Principle.

RFM analysis — as a method to identify high-response customers in email marketing promotions and to improve overall response rates, applying RFM scores to your customer database and measuring how they migrate from one classification to another over time — is of paramount importance for e-commerce businesses that understands that intelligence (knowing the different types of customers and how they behave) is the biggest competitive advantage that an online store can have.

Why does RFM analysis work?

1. Customers who bought from you recently are more likely to respond to your next promotion than those whose last purchase was a long time ago. This is a universal principle that can be observed in almost all segments: insurance, banking, retail, travel, etc.

2. It is also true that frequent buyers are more likely to respond than less frequent buyers.

3. Those who spend more generally respond better than those who spend less.

These are the three basic principles behind RFM Analysis.

A CRM that applies RFM Analysis takes these three principles, quantifies them and codes its customers in 10 RFM classifications, based on their consumption behaviors.

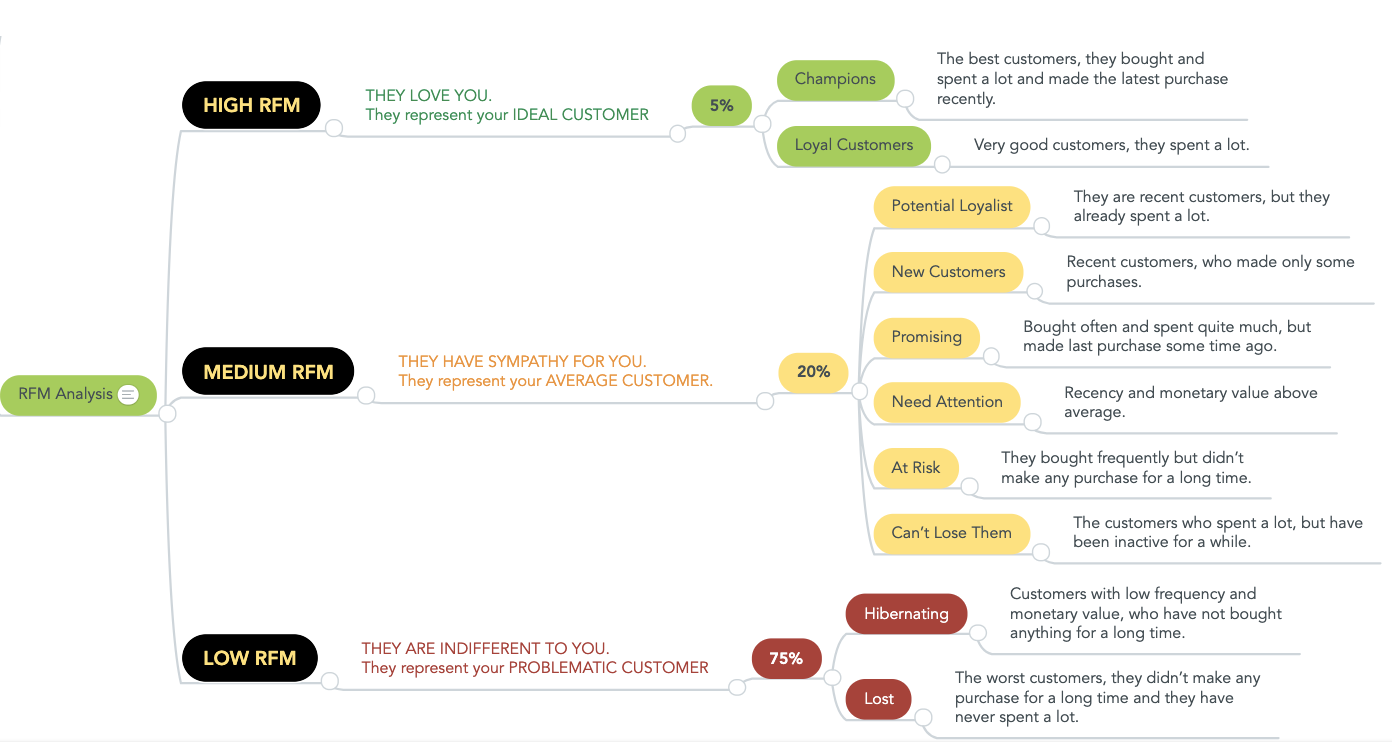

These classifications are graphically represented in the so-called “RFM Grid”:

Below, an example of how we can score these variables in order to classify a customer’s importance based on their buying behavior?

Recency (can/should be customized according to the e-commerce segment):

- Recency = 4 (bought in the last 1 to 7 days)

- Recency = 3 (bought in the last 8 to 14 days)

- Recency = 2 (bought in the last 15 to 30 days)

- Recency = 1 (bought more than 31 days ago)

Frequency (based on quartiles, has as reference the behavior of all other customers of this store):

- Frequency = 4 (quartile 4)

- Frequency = 3 (quartile 3)

- Frequency = 2 (quartile 2)

- Frequency = 1 (bought only once)

Monetary [Value] (based on quartiles, has as reference the behavior of all other customers of this store):

- Monetary [Value] = 4 (quartile 4)

- Monetary [Value] = 3 (quartile 3)

- Monetary [Value] = 2 (quartile 2)

- Monetary [Value] = 1 (quartile 1)

How do we describe each of these 10 classifications?

First, we’ll group these classifications into three strategic groups so you’ll have a macro view of your base, and then we’ll deal with them one by one:

– Customers with HIGH RFM (Champions / Loyal Customers) — this group includes your best customers. THEY LOVE YOU. They represent your IDEAL CUSTOMER. A good deed is to always make these customers feel special. They are the customers to whom you will first show your new products; they are the ones to whom you will show your exclusive products, or those with limited units. These customers are more likely to advertise your brand, they are the ones who usually leave their positive testimonials about their shopping experiences in your store — encourage them to do this. Take advantage of the principle of reciprocity! [In general, this group represents 5% of your customer base.]

– Customers with MEDIUM RFM (Potential Customers / New Customers / Promising / Need attention / At risk / Can’t miss them) — this group includes your most recent customers, however, with low to medium frequency and/or low to medium spending, and your customers with medium to high frequency and/or medium to high spending, however, not so recent. THEY HAVE SYMPATHY FOR YOU. They represent your STANDARD CUSTOMER. Inform them about your specific promotions at the moment (always generating a sense of urgency). Develop brand awareness in your customers’ minds. A good mindset for creating your communications for these customers is: “These customers don’t deserve to be customers of my competitors! I need to help them prevent this from happening!” [In general, this group represents 20% of your customer base.]

– Customers with LOW RFM (Hibernate, Lost) — this group includes your worst customers — they don’t buy often, they didn’t spend much when they bought and they haven’t bought in a long time. THEY ARE INDIFFERENT TO YOU. They represent your WORST CUSTOMER (if only they existed, your store would not exist). Here you will offer your most aggressive discounts, will show the so-called “irresistible offers” and will speak, even more directly, to their “survival instinct”, known by neuroscience as the reptilian brain (triune brain theory) and by modern psychology as FOMO (Fear of Missing Out). It’s now or never! [In general, this group represents 75% of your customer base.]

Now, let’s see a brief description of each of these 10 classifications:

1. Champions

Your best customers, they buy and spend a lot and made their last purchase recently.

2. Loyal Customers

Very good customers — they spend a lot.

3. Potential Loyalist

Recent customers, but who have already spent a lot.

4. New Customer

Recent customers, who made only a few purchases.

5. Promising

Customers who buy frequently and spend a lot, but made their last purchase some time ago.

6. Need Attention

Customers with recency and above average spending.

7. At Risk

Customers who bought frequently, but haven’t made any purchases in a long time.

8. Can’t lose them

Customers who have spent a lot, but have been inactive for a long time.

9. Hibernate

Low-frequency, low-spender customers who haven’t bought in a long time.

10. Lost

Your worst customers. They haven’t bought in a long time, they only bought once (or very few times) and they spent very little.

Conclusion

As you can see, it doesn’t make much sense to send emails to your entire base without discriminating your message according to each type of customer.

If the most valuable currency on the market is “attention”, the “central bank” that facilitates the circulation of that currency is called “personalization”.

There are, of course, several ways to create personalization, however, when done from the RFM analysis, you ensure that your strategies for attracting qualified leads are increasingly assertive, since you will have more accurate data about your ideal customer, so that you can more and more attract this type of customer to your online store.

The more customization, the more attention. The more attention, the more sales.

So… let’s “RFM”?

Andre Floriano

Country Manager

edrone

Brazilian living in Poland. Lived for 10 years in the U.S. With experience in international business management and marketing. Currently, Country Manager at edrone Brazil.

Do you want to increase sales and build even better relationships with your customers?